Amazon Business Exit Strategy to Maximise Your Valuation

M&A Exit

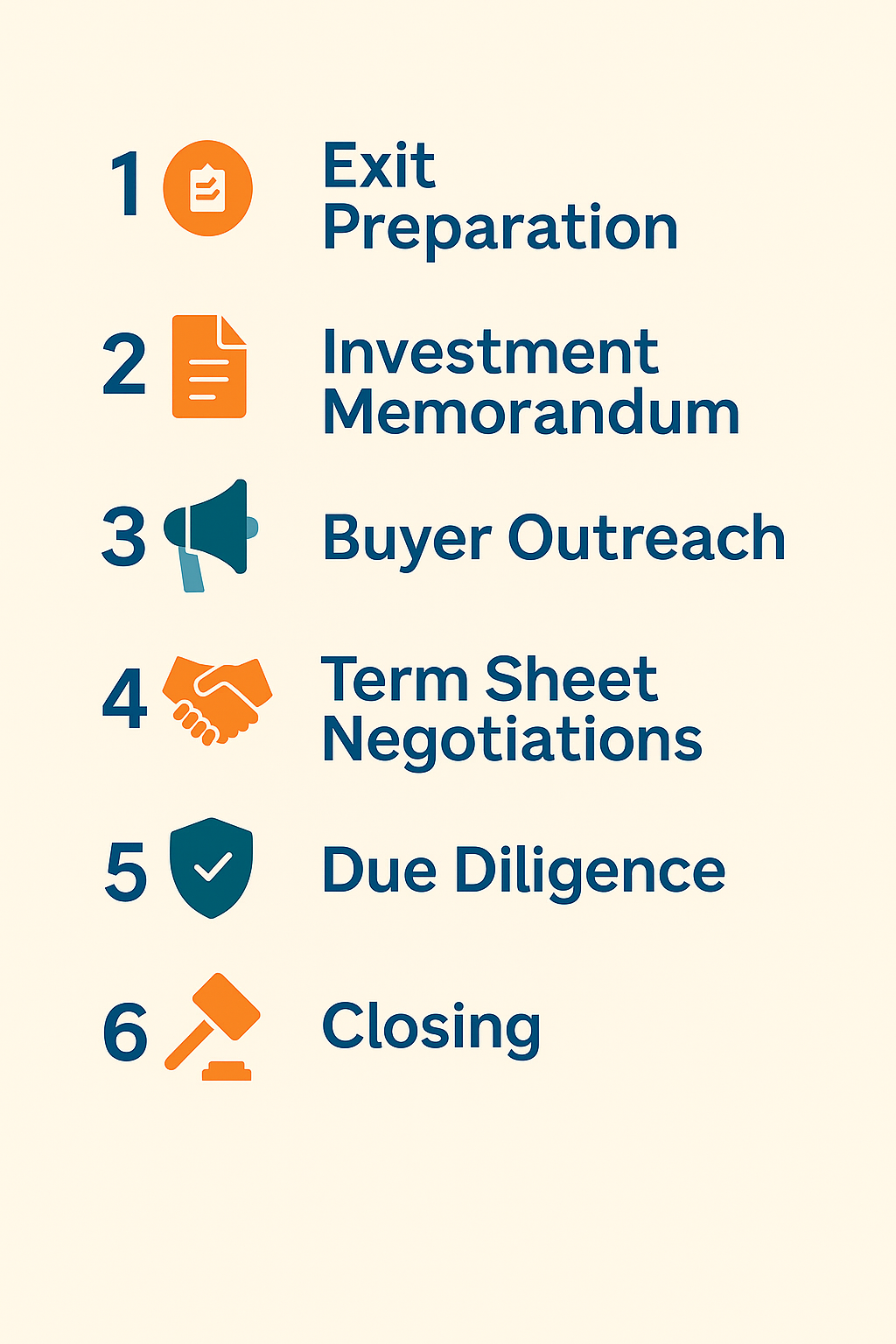

Selling your Amazon business is exciting but complex. With our tailored Amazon FBA exit planning and M&A advisory, we help you maximise value, prepare for due diligence, and secure the best possible deal.

-

Successful exits start early. We help you prepare at least 12 months in advance, cleaning financials, improving operations, and reverse-engineering scrutiny points to maximise your business valuation.

-

We create a professional investment memorandum to present your brand to buyers. This includes financials, product overview, supply chain details, SWOT analysis, and growth opportunities; everything needed to showcase value.

-

With valuation optimised and the IM ready, we approach vetted buyers under NDA. From initial interest (IOI) through to LOIs, we guide you through each step of buyer engagement and negotiations.

-

Every deal is unique. We negotiate terms and structures that work for both sides, providing expert Amazon M&A advisory to ensure you're positioned for the best outcome.

-

We support you through rigorous Amazon business due diligence, managing buyer requests and defending adjustments to EBITDA. With our guidance, you're prepared for scrutiny and surprises.

-

Once due diligence is complete, we finalise agreements, transfer funds, and manage the transition period, ensuring a smooth and successful Amazon business exit.

Contact Us

Ready to sell your Amazon FBA business? Our expert Amazon business sale consultants guide you through valuation, preparation, and negotiations. Contact us today to plan your exit.